We’ve paid customer claims amounting to more than USD 241 million, with 98% of all life claims paid out.

Key findings and insights

The deadly duo

One out of two people in the region have died because of either cancer or heart disease

Stay safe on the roads

Road accident death claims have reached an all-time high, accounting for 6% of total claims

Women, take care of your heart

We’ve seen a 50% jump in heart attack and stroke related death claims for women since 2020

Decoding death claims

By looking at what causes deaths, we learn about the risks we face. Having this knowledge helps you have those difficult conversations and take early action to protect yourself and the ones who love you.

Every year, it’s happening sooner

Talking about death and uncertainty is an act of love.

While we don’t want to alarm you, we hope you are encouraged to have these tough conversations, that will prepare you and your loved ones for a secure financial future.

Shilpa Chitanand

Head of Retail Distribution

Live life fully with the power of living benefits

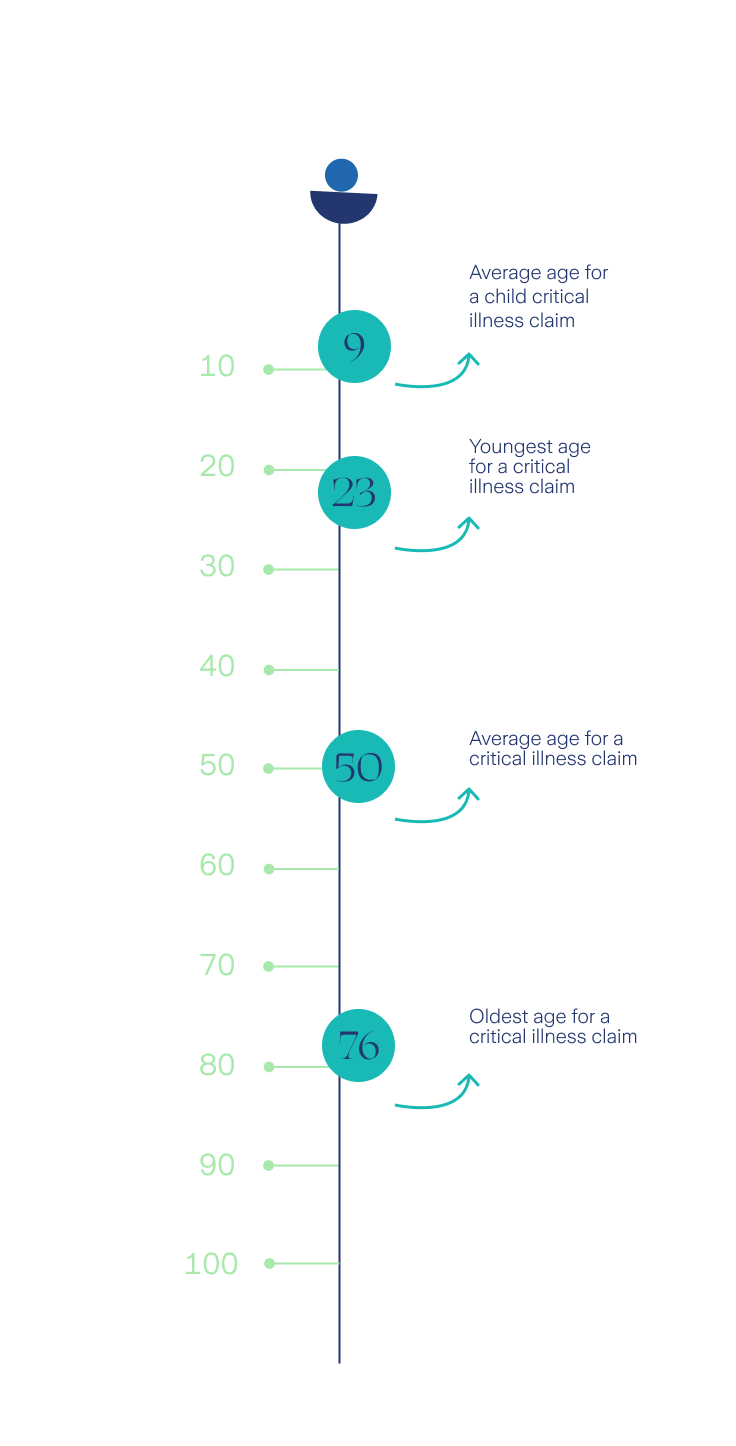

Here we highlight the leading causes of critical illness claims in the Middle East.

We call these living benefits.

This means that as a customer you get access to money from your policy if you’re diagnosed with a listed critical illness like a heart attack or cancer.

Embrace the uncertainty in life’s journey

A secure future depends on the choices you make today - embracing a vibrant and healthy lifestyle and building a well thought out financial plan.

Deepak Gaur

Head of Claims and Corporate Operations

Read more about our new Medical Second Opinion (MSO) service through our partnership with Further.

Women - take charge of your future

Understanding the risks, gaps, and the path forward.

50% increase in claims for heart attacks amongst women since 2020.

Smoking is a greater risk factor for heart disease in women than it is in men.

3 out of 5 women insured with us have a cover of less than $200,000.

Earning your trust, one claim at a time

Every year, more and more people rely on us to be there for them during their toughest times.

Over the last three years we’ve paid out more than USD 241 million in claims – and we remain committed to keep our promise to you going forward.

We believe everyone deserves to be insured

We may accept your application, even if you have pre-existing conditions. This will be subject to further underwriting which could expose you to additional premiums, underwriting rating, and addendums to your policy. Unfortunately, we may sometimes need to decline coverage.

Trust us to pay you, promptly, wherever you are

When choosing a life insurance company, look for their promise to you. Financial stability, claims payout data, and transparency are the top three trust metrics, to ensure that your family is safeguarded.

That’s why the data in this report is important for you, so that you can make informed choices.

Because a life worth living, is a life worth insuring.

Rayner Britto

Head of Retail Business