Over the last three years, we’ve paid over USD47 million in corporate life insurance claims.

1 in 5

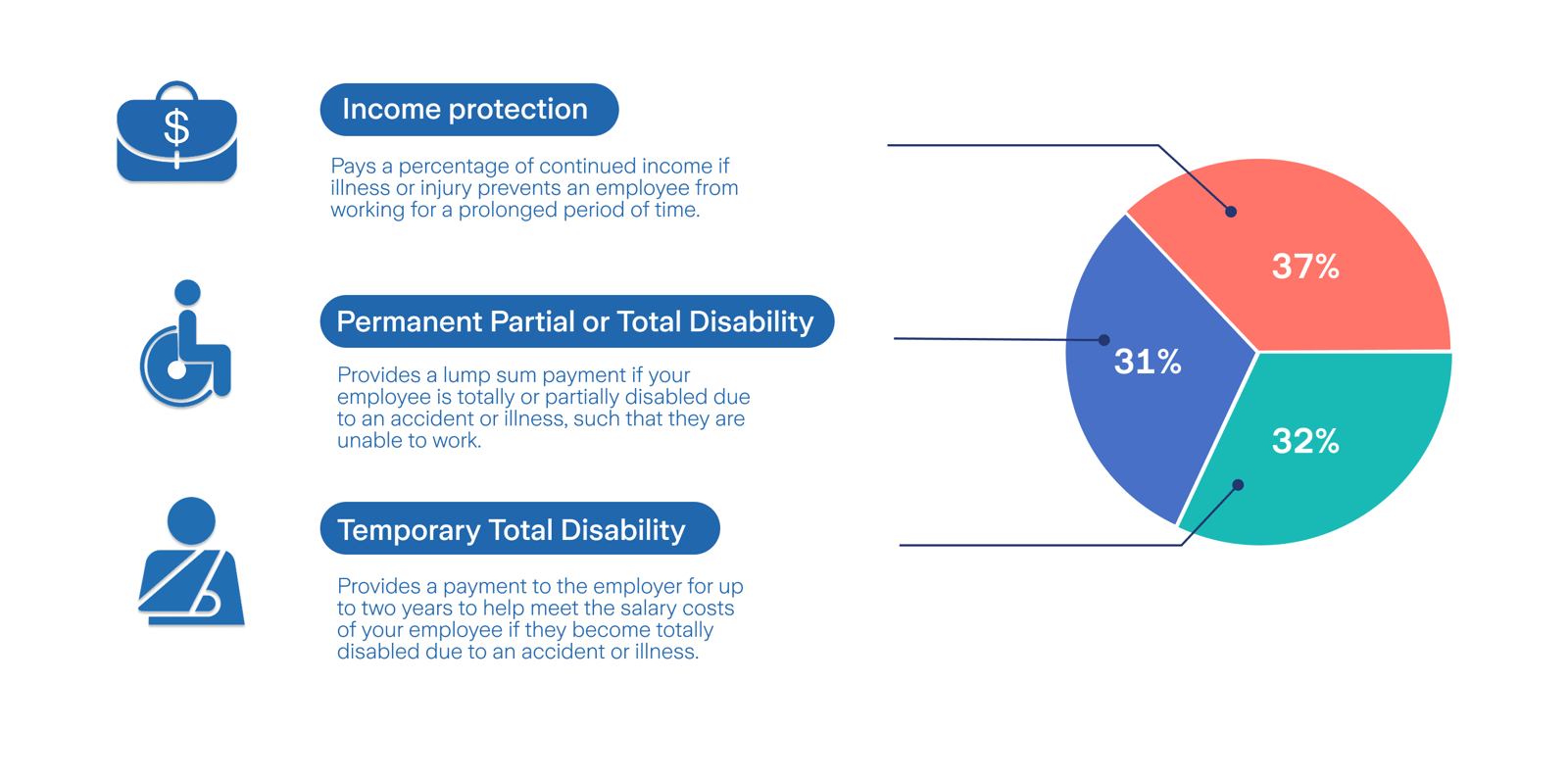

of every claims paid out to our corporate customers was for disability. This means they were able to access their policy benefits while still alive.

Peace of mind is your employee's superpower

Disability benefits provide employees with financial support, in the event of a serious illness or injury.

As we explore the latest data, it’s clear that safeguarding the well-being of employees is key to sustainable growth and success.

By sharing and understanding our data, we hope to help organisations create thriving workplaces where employees feel motivated and supported through every stage of life.”

Swarnaleka Shetty

Head of Sales & Distribution, Corporate Life & Pensions, Middle East

Financial resilience for any age = long term employee happiness

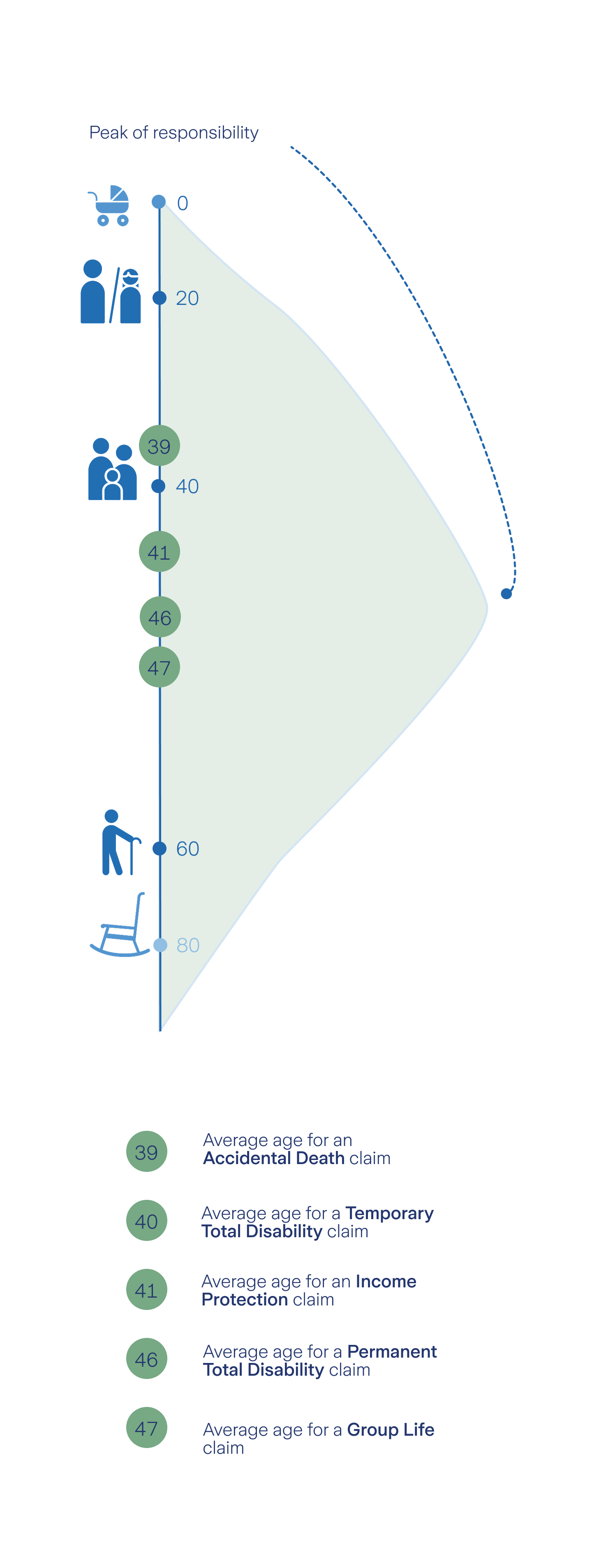

Given that most claims arise when employees are at the height of their responsibilities like balancing costs of higher education, mortgage payments, or caring for aging parents, providing life and living benefits is essential. These benefits not only support employees during critical life stages but also enhance their overall well-being and productivity in the workplace.

Let your employees fall back on a financial safety net

The average age for income protection has decreased from 51 to 41 years.

This reflects a growing recognition of the importance of financial security in the workplace.

One of the most important developments in employee well-being today is Income Protection. This disability benefit is a simple but powerful safety net it helps by paying a portion of an employee’s salary when they’re facing a serious illness or can’t work for a long time.

This trend also shows that more organisations are understanding how supporting employees through tough times helps create a stronger, more resilient team. It helps foster a workplace culture that cares and feels stable.

Rob Brown

Head of Corporate Life & Pensions Business, Middle East

Experience the confidence of our reliability across the region

We insure on behalf of our clients $46.7 billion across five countries in the GCC including the UAE, Oman, Bahrain, Qatar and Saudi Arabia.

Learn more about our Group Life solution.